fresh start initiative irs reviews

2022 Fresh Start Initiative Reviews. Also taxpayers can now avoid a tax.

3 Myths Surrounding The Irs Fresh Start Program

If you cant fully pay your tax bill then you may qualify for one or more options under the IRS Fresh Start Program.

. The following four tips explain the expanded relief for taxpayers. The Fresh Start initiative offers taxpayers the following ways to pay their tax debt. Relief under the IRS Fresh Start Initiative.

However taxpayers should be aware that this isnt a magic wand or get out of jail free card. Fresh Start Tax Relief started back in 2005 and is based in Chicago Illinois. If so the IRS Fresh Start program for individual taxpayers and small businesses can help.

In the vast majority of cases taxpayers will still pay a large portion of the taxes due. Specifically the IRS is announced new policies. Ultimately the goal is to allow citizens to pay taxes without liens and excess fees.

The two most common repayment options under the Fresh Start Program are extended installment agreements and Offer in Compromise OIC. The IRS Fresh Start program can help deserving taxpayers get back on their feet financially. The IRS will continue to review and where appropriate modify or expand the People First Initiative as we continue reviewing our programs and receive feedback from others Rettig said.

Basically this is how this IRS Fresh Start program works. Not having the funds available to cover a tax bill can feel devastating. Community Tax has expertise in releasing tax liens and can help you get IRS resolution through the IRS Fresh Start program.

Now to help a greater number of taxpayers the IRS has expanded the program by adopting more flexible Offer-in-Compromise terms. Fresh Start Initiative is a tax relief matching service for those struggling with tax debt. January 6 2022.

This blog post will introduce what the IRS Fresh Start Initiative is about and how it works. Finding an option to settle your tax debt is a lot easier now as the tax relief options available add more potential ways to mitigate tax debts if. The Fresh Start program increased the amount that taxpayers can owe before the IRS generally will file a Notice of Federal Tax Lien.

Fresh Start Initiative is a relative newcomer in the tax relief industry. For some individuals this scenario can haunt them for some time. The company is based out of Ladera Ranch California.

Service-fee financing options available. It is important to note that the Fresh Start Tax Lien modification is not retroactive so the IRS cannot automatically withdraw a lien that was filed prior to Fresh Start based on the previous rules. In 2018 the IRS approved 994777 installment agreements making it the most widely used tax debt relief payment option under the IRS Fresh Start Initiative.

The goal was to help individuals and small businesses meet their tax obligations without adding unnecessary burden to taxpayers. For example a taxpayer who qualifies for an OIC see this article about OIC qualification and has 500 in monthly disposable income and 5000 in net equity in assets would see their OIC offer amount drop from 29000 pre-Fresh Start to 11000 with Fresh Start. The IRS began Fresh Start in 2011 to help struggling taxpayers.

This is actually the most helpful IRS Fresh Start program of course ignore their nonsense offer in compromise pre-qualifier as it is garbage. The reason is that the Fresh Start Initiative changed IRS collection policy to lower the total. The IRS Fresh Start Streamlined Installment Agreement allows you to quickly set up an Installment Agreement with the IRS to repay back taxes over a fixed period with a fixed monthly payment usually without providing financial information.

New IRS Fresh Start Initiative Helps Taxpayers Who Owe Taxes. Penalty relief Part of the initiative relieves some unemployed taxpayers from failure-to-pay penalties. The Program offers taxpayers relief with their back taxes.

IRS Fresh Start Offer in Compromise. With an A BBB rating and over 100 customer reviews with an average rating of five stars Community Tax is a Solvable top-rated tax assistance firm. IRS Fresh Start Program Taxpayers that have back taxes may qualify for tax relief in as little as 20 minutes.

The IRS changed reasonable collection potential calculations from multiplying your. This expansion will enable. The Fresh Start Initiative grants more flexible repayment terms for taxpayers to pay or absolve their back taxes without incurring penalties.

An Offer in Compromise is an attractive option for people with large. There are three types of streamlined Installment Agreements. Best for individuals with over 8000 in debt.

However in some cases the IRS may still file a lien notice on amounts less than 10000. Quickly Solve Your IRS Problems - Free Consultation. That amount is now 10000.

Money-Back Guarantee if overall tax liability or monthly payments arent reduced. If you are a US taxpayer or have IRS tax debt you may be eligible for the IRS Fresh Start Initiative. Once referred to as the Fresh Start Program the Fresh Start Initiative is actually an updated set of guidelines for pre-existing IRS programs that help more people qualify for some much-needed tax debt relief.

The company offers a guided tax relief option for the IRS Fresh Start initiative for a flat fee and utilizes enrolled agents to help clients reach financial freedom. The IRS Fresh Start Program launched in 2011 is an initiative designed to make it easier for taxpayers to resolve tax debt by giving them a fresh start with the Internal Revenue Service. The Internal Revenue Service has expanded its Fresh Start initiative to help struggling taxpayers who owe taxes.

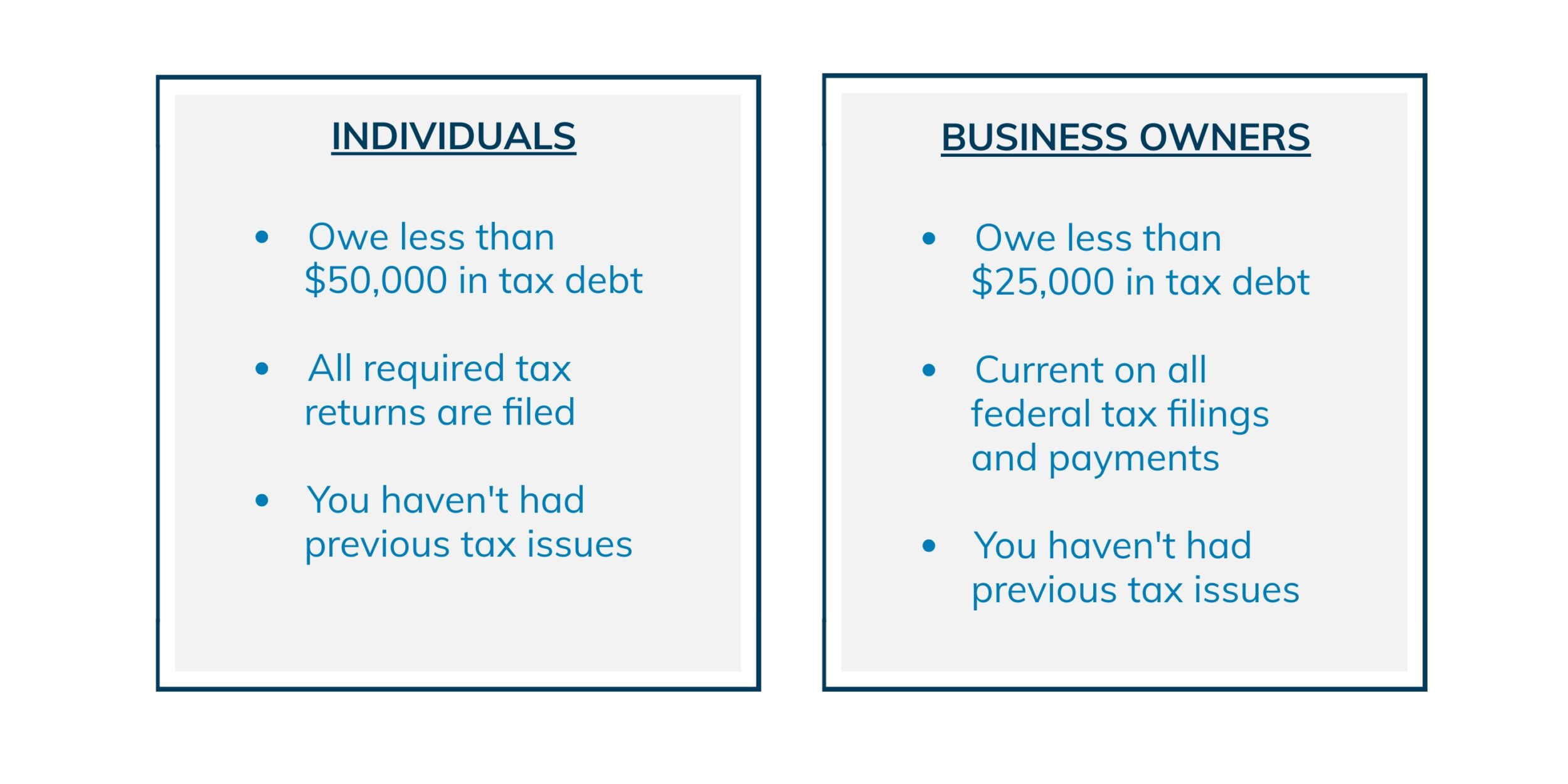

The Fresh Start program increased the threshold to qualify for a streamlined installment agreement from 25000 to 50000 if the balance can be paid in full within six years previously five years. Within the IRS Fresh Start Initiative program there are different tools available to help struggling individuals and small businesses pay off andor get rid of some of their debt. This program allows people to make a one-time payment of their IRS tax debt and avoid penalties and interest.

IRS Fresh Start Initiative in Texas. So helpful I actually wonder how much longer it will last. In 2011 the Internal Revenue Service announced a series of new steps to help people get a fresh start with their tax liabilities.

We are committed to helping people get through this period and our employees will remain focused on these and other helpful efforts in the days and weeks ahead. 1 36-month repayment for balances of 10000 or less 2 72-month. The IRS Fresh Start initiative expanded several programs to help taxpayers struggling with unpaid tax debt.

Tax Fresh Start Initiative Offerings. The Fresh Start Program has increased the IRS Notice of Federal Tax Lien filing threshold from a minimum liability of 5000 to 10000. They offer a streamlined approach to tax relief and utilize many partners such as certified public accountants enrolled agents and other tax experts to match the consumer with the professional who can help their case the most.

Within the Fresh Start Initiative there are different types of relief available. The company partners with companies that employ IRS enrolled agents Certified Public Accountants and tax attorneys to help consumers address and resolve tax debts.

3 Ways To Be Eligible For The Irs Fresh Start Program

3 Ways To Be Eligible For The Irs Fresh Start Program

Everything You Need To Know About The Irs Fresh Start Initiative 2019

Follow Irs Fresh Start Initiative On Other Platforms Fresh Start Social Media Irs

The Federal Government Offers To Wipe Out Your Tax Debt Through New Irs Fresh Start Program Fresh Start Information Tax Debt Start Program Irs

Am I Eligible For The Irs Fresh Start Program Tax Defense Network

Everything You Need To Know About The Irs Fresh Start Initiative 2019

![]()

What S The Irs Fresh Start Program The New Initiative Guide Video

![]()

What S The Irs Fresh Start Program The New Initiative Guide Video

Irs Fresh Start Program How It Can Help W Your Tax Problems

Owe Money Get A Fresh Start With The Irs Fresh Start Initiative The Turbotax Blog

![]()

What S The Irs Fresh Start Program The New Initiative Guide Video

What Is The Irs Fresh Start Program Fresh Start Initiative Explained Clean Slate Tax

![]()

What S The Irs Fresh Start Program The New Initiative Guide Video

Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program

3 Ways To Be Eligible For The Irs Fresh Start Program

Owe Money Get A Fresh Start With The Irs Fresh Start Initiative The Turbotax Blog

Irs Fresh Start Connecting Taxpayers With Tax Professionals

Irs Fresh Start Program How Does It Work Infographic Start Program Irs Fresh Start